Gravitas is proud to be part of Myer’s ‘secret sauce’ for success, transforming loyalty through Customer Value Management and differentiated customer experiences.

Carrie LaFrenz – Senior reporter, Australian Financial Review

Mar 22, 2024

How loyalty saved Myer from the retail graveyard

In 2019, Myer’s loyalty scheme was terminal; unattached shoppers were outspending members of Myer One dollar for dollar. The program was placed under review by then-newly installed chief executive John King and barely rated a mention with investors.

Five years later, it is central to not just Myer’s survival but its entire value proposition, with 4.3 million active shoppers and more than 7 million accessible members. Today, most of Myer’s sales – which hit $1.8 billion in the December half – are at the hands of Myer One members.

Data drive – the retailer has capitalised on its ‘secret sauce’.

The relentless focus on Myer One has improved results on all the major loyalty tracking metrics: greater engagement, new member acquisition and spending, personalisation and rewards.

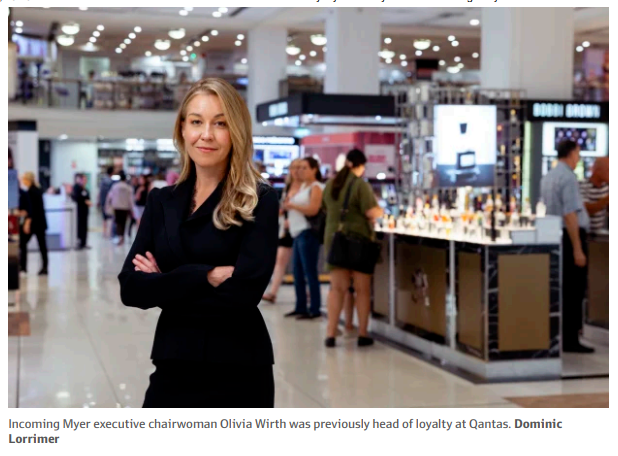

The retailer, backed by billionaire Solomon Lew, has just appointed Olivia Wirth to run the business and in doing so, backed an executive who has zero department store experience but has a successful track record running Qantas Frequent Flyer.

It’s no different at Australia’s biggest retailer Woolworths, where Amanda Bardwell who heads Woolies X (digital and loyalty) was named Brad Banducci’s successor, putting loyalty and data front and centre.

Philip Shelper, the founder of consultant Loyalty & Reward Co, says Myer makes for a great case study. “It’s not something that you see often. Usually, a loyalty program is complementary to the business. I think that’s given them the confidence to say, ‘loyalty is the secret sauce for us’,” he says.

“The Myer partnership program, you could argue it’s still very much in its infancy and there’s an enormous amount of mileage out of that if they get more focused on it. “Woolworths and Coles have done a great job in getting suppliers to fund all the bonus earn activity through their programs, and using AI. We’ve not ever seen it happen in a department store within Australia before.”

Myer’s reputation for excellence now spans the globe, evidenced by an impressive array of international award nominations. Building on its success, Myer has been nominated for the second consecutive year in four categories at the prestigious International Loyalty Awards for best use of customer data / analytics, best loyalty industry innovation, best loyalty program marketing campaign, and best long term loyalty program, with winners to be announced on 24 April 2024.

More complexity, more data

Loyalty programs are rapidly growing in sophistication and complexity, collecting more data. AI-powered engagement is improving communication by making it more personalised, but the programs that are really succeeding are bringing in partnerships and suppliers”.

Myer One has partnerships with Virgin, Amex and Commonwealth Bank.

Myer launched Myer One in 2004, replacing Flybuys when Myer was separated from the old Coles Myer. Its premise today is no different from 20 years ago.

So how did Myer supercharge its loyalty program such that it is integral to its

strategy?

“Supermarkets have harnessed suppliers to fund bonus points, airline programs utilise their partners to provide new earn opportunities, and Myer One has done a top job in developing a platform that enables brands to create their own campaigns targeted at desirable cohorts,” says Shelper. “The real battle within loyalty programs is being fought over the delivery of meaningful value. Those programs that are providing it to their increasingly savvy members are winning, while the rest suffer their plastic membership card being thrown in the recycling bin.”

Rewards and the ability to use points as currency is increasingly important.

Myer outgoing CEO John King told The Australian Financial Review earlier this month 76 per cent of Myer’s sales are attached to Myer One members. That is not the only source of its turnaround – King has downsized real estate and recruited better brands into stores too.

“It doesn’t matter whether you’re selling an airline ticket or a dress, all the principles are still the same. But what’s really important for us is scalable data and customer loyalty, which are exactly what we need to lead us to our next growth horizon,” he said at the time.

Members are coming back

Shelper says many loyalty schemes, particularly in supermarkets, are finding

lapsed customers re-engaging, given pressure on household budgets.

“Typically, if a customer joins a loyalty program and they stop engaging with it, you never see them again. It’s very hard to get them to come back. Now that is happening at scale, which indicates a lot of consumers are really hurting, and doing everything that they can to find value.”

Myer customers with the greatest potential return are those who are high value, in decline, and one-off. This enables Myer to accurately identify which customers to court, and which to ignore, yielding “much better bang for their buck,” in Shelper’s words.

Brand partners are most attracted to the high-value customers.

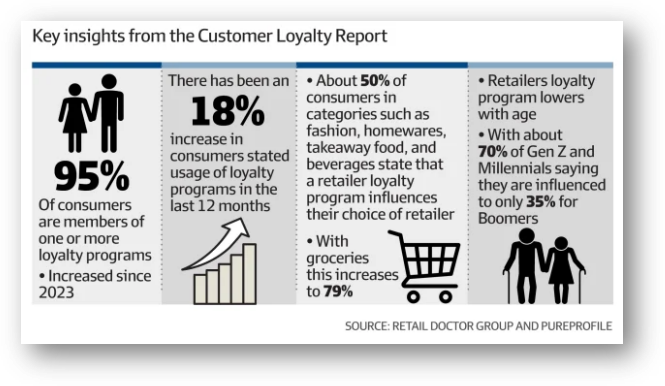

There has been an 18 per cent increase in consumer use of loyalty programs in the past 12 months, according to Retail Doctor Group and Pureprofile research. They found that about half of respondents surveyed in categories such as fashion, homewares, and takeaway food and beverages, agree a retailer’s loyalty program influences their purchasing.

However, this effect diminishes with age, with 70 per cent of Gen Z and Millennials

saying they are influenced, compared with only 35 per cent for Baby Boomers, the research found.

From Amazon Prime, the Wesfarmers-backed OnePass, Coles’ Flybuys and Woolworths’ Everyday Rewards, and Priceline’s Sister Club, loyalty is a battleground, says industry expert Aussie Merciadez.

She says Myer stands out for putting the right offer in front of the right customers.

Merciadez says there are customers who are simply looking for deals, but if a retailer gets the customer’s “rhythm and profile right” then it can drive the bottom line.

Carrie LaFrenz is a senior journalist covering retail/consumer goods. She previously covered healthcare/biotech. Carrie has won multiple awards for her journalism including financial journalist of the year from The National Press Club. Connect with Carrie on Twitter. Email Carrie at [email protected]

If you’d like to learn more about our Customer Value Management approach please reach out today.