Banking – from product-led to putting the customer first

Gravitas Customer Value Management (CVM) segmentation enabled more personalisation, for more engagement.

Building lifelong relationships and engendering greater loyalty

Value segmentation which better reflects evolving customer needs.

Gravitas CVM segmentation enhances existing customer profiles by defining their current and potential value as they migrate from a new customer to a brand loyalist. Through the determination of a truer life-stage customer value this bank was able to proactively recommend:

- Selective right-planning of accounts; and

- Investment in a personalised health of the relationship customer check-in at branch

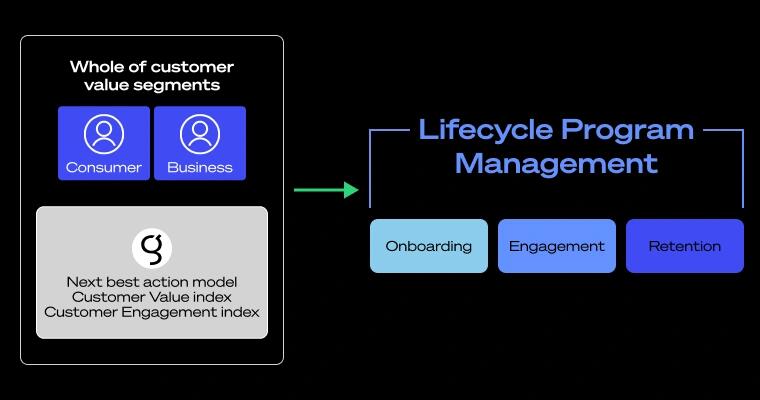

Gravitas Customer Value Management (CVM) Segmentation

Gravitas CVM segmentation harnessed customer cohort attributes and characteristics to shift engagement from product-focused communications into a more tightly choreographed stream of personalised communications.

We achieve proven results

4x

The Gravitas value-based engagement (proof-of-concept test) resulted in 4 times the response rate to the previous non-personalised approach.

+56%

Customers invited to a personalised health-of-the-relationship checkin at branch resulted in a 56% increase in sales (versus control).

Key success factors

CVM cohort attributes and characteristics drive life-stage engagement and enable more personalised, relevant communications.

CVM data informs the development of creative and tonally different communications which reflect relationship status.

CVM segmentation enables common, cross-company understanding of customer life-stage engagement strategies.